Finance (Baumgarten)

Looking for Finance (Baumgarten) test answers and solutions? Browse our comprehensive collection of verified answers for Finance (Baumgarten) at elearning.thws.de.

Get instant access to accurate answers and detailed explanations for your course questions. Our community-driven platform helps students succeed!

A difference between IRR compared to NPV in decision-making is that__________

❌

✅

❌

❌

View this question

The owners of a corporation are personally liable for the corporation's debts.

❌

✅

View this question

Your friend offered you the alternative to invest $40,000 during a year with the assurance to get $46,000 at the end of the year which will give you a _______ IRR on your investment.

❌

❌

❌

✅

View this question

The separation of ownership and control in a company eliminates all conflicts of interest between stakeholders.

0%

0%

View this question

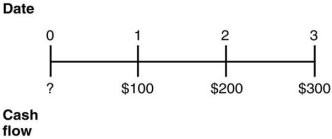

Consider the following timeline: If the current market rate of interest is 9%, then the present value of the cash flows on this timeline as of year 0 is closest to:

If the current market rate of interest is 9%, then the present value of the cash flows on this timeline as of year 0 is closest to:

0%

0%

0%

0%

View this question

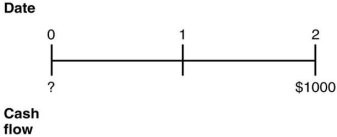

Consider the following time line: If the current market rate of interest is 8%, then the present value of the cash flows on this timeline is closest to:

If the current market rate of interest is 8%, then the present value of the cash flows on this timeline is closest to:

❌

❌

❌

✅

View this question

Use the following information to answer the question(s) below.Consider the following four alternatives:1. $132 received in two years.2. $160 received in five years.3. $200 received in eight years.4. $220 received in ten years.The ranking of the four alternatives from most valuable to least valuable if the interest rate is 7% per year would be:

❌

❌

✅

❌

View this question

Use the following timeline to answer the question(s) below.

At an annual interest rate of 7%, the future value of this timeline in year 3 is closest to:

| 0 | 1 | 2 | 3 |

| | $600 | $1200 | $1800 |

0%

0%

0%

❌

View this question

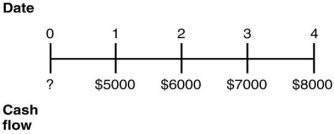

Consider the following timeline detailing a stream of cash flows: If the current market rate of interest is 8%, then the present value of this stream of cash flows is closest to:

If the current market rate of interest is 8%, then the present value of this stream of cash flows is closest to:

0%

0%

❌

0%

View this question

Use the following information to answer the question(s) below.Nielson Motors is considering an opportunity that requires an investment of $1,200,000 today and will provide $1,350,000 three years from now.The internal rate of return of this project is closest to:

❌

❌

✅

❌

View this question